Philip Friedman/Studio D

Washington power players, politicians and the mainstream media are all focused on possible Trump/Russian election collusion, Jared Kushner’s security clearance, a porn star’s accusation of marital infidelities with President Trump and confirmation hearings for a new Secretary of State and a new CIA Director. All of these issues are important and do impact American political life, but in terms of what directly impacts the daily lives of Americans, it’s a lot of attention on what matters least and very little attention on what matters most, the consumer protection of American citizens.

The Consumer Financial Protection Bureau (CFPB) self-described definition is a U.S. government agency that makes sure banks, lenders, and other financial companies treat American consumers fairly. CFPB jurisdiction includes banks, credit unions, securities firms, payday lenders, mortgage-servicing operations, foreclosure relief services, debt collectors and all other financial companies operating in the United States. The Bureau’s priorities are mortgages, credit cards, and student loans, the things that impact the everyday lives of American citizens.

In other words, it’s the one government agency whose sole agenda is consumer protection. It’s not to protect or help the bottom line of business, but to help and protect the bottom line of the consumer.

The ability to qualify for a mortgage at a reasonable rate, or a student getting a fair loan to finance their education is what matters most to the average American citizen. Not whether Jared Kushner has the necessary security clearance.

Unfortunately, while all the attention is being focused on these political issues the CFPB is taking a hit in 2 important ways while no one is paying attention.

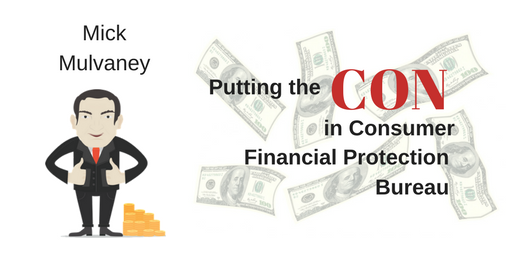

Richard Cordray was the 1st Director of the CFPB, it was a full-time job for him, now the new Director Mick Mulvaney does it as a second part-time job

1) Leadership- Last November former Director Richard Cordray resigned, instead of appointing a new full-time replacement President Trump chose to appoint the current Director of the Office of Management and Budget, Mick Mulvaney, as acting director, to do the job of leading the 1600 plus person staff part-time. The agency whose full-time job is consumer protection for the American public now has a part-time leader.

President Trump appointed OMB Director Mick Mulvaney to be Acting Director of CFPB and its 1600 plus staff part-time while he still serves as Director of OMB. Some consider this a secret plan to sabotage the CFPB because as a Congressman Mulvaney introduced legislation to close down the CFPB

2) Enforcement- As the Boston Globe reports since taking over the agency three months ago, Mulvaney has dropped a lawsuit against payday lenders charging more than 900 percent interest in Kansas, crippled the part of the agency that punishes lenders for racial discrimination, and urged the CFPB’s employees to act with more “humility and moderation.”

The agency hasn’t filed a single enforcement action under Mulvaney’s reign, in sharp contrast to the CFPB’s average before he took the job of at least three actions a month. Mulvaney told employees in a memo that he wanted them to move away from enforcement except in extreme situations.

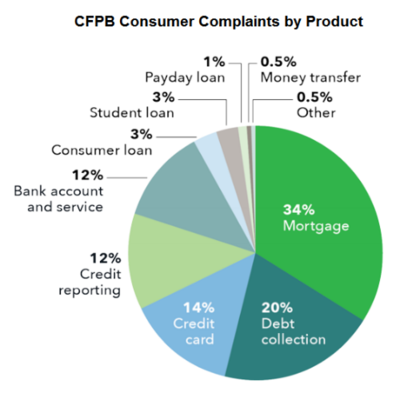

Image from: CFPB, Consumer Response: A Snapshot of Complaints Received July 21, 2011 through June 30, 2014

The CFPB is charged with managing the Credit Card Accountability Responsibility and Disclosure Act, a.k.a. the Card Act signed into law by former President Barak Obama in 2009. The purpose of the Card Act is to “establish fair and transparent practices relating to the extension of credit.” The Los Angeles Times points out that under Mulvaney’s part-time leadership management of the Card Act is changing.

When the CFPB issued its first report on the effects of the Card Act in 2013, it credited the law with creating “a market in which shopping for a credit card and comparing costs is far more straightforward than it was prior to enactment of the act.” The agency still found a number of areas of concern requiring further scrutiny, including add-on products such as identity-theft protection, which CFPB said are “frequently sold in a manner that harms consumers.”

The CFPB does a good job of keeping credit card companies from abusing customers with unfair fees

The second report in 2015 reiterated concerns over practices “that still create risks to consumers.” The latest report — the first under Mulvaney’s watch — was released in December. It has no concerns about the credit card market. Rather, it says “the market shows significant innovation” and, overall, there’s “a positive picture for consumers in the credit card market.” But as Linda Sherry, a spokeswoman for the advocacy group Consumer Action says “The problems from the earlier reports did not disappear overnight from the marketplace, this latest report is just willfully ignoring them.”

Before Mulvaney, the CFPB’s top goal was to “prevent financial harm to consumers while promoting good practices that benefit them.” He rewrote that mission statement, now CFPB’s main goal is to “ensure that all consumers have access to markets for consumer financial products and services”, regardless of whether or not the products and services meet the goal of consumer protection.

Part-time Director Mulvaney doesn’t believe in the CFPB’s mission of consumer protection, he thinks its government over reach and the agency should be shut down. Since the law won’t allow him to shut it down he’s stopping it from taking any action against financial abusers

Since 2011 the CFPB has returned 11.9 billion dollars in refunds and debt relief to consumers from financial institutions who engaged in unfair practices. As a result, Republicans and many financial firms have said the CFPB has been too aggressive in enforcing consumer protection laws. They also accuse it of drafting too many new regulations to avoid future abuses. Part-time Director Mulvaney on his first day as part-time director was quoted as saying “Look, I’m not here to shut the place down because the law doesn’t allow me to do that. That being said, we’re going to run it differently than the previous administration.”

Part-time Director Mulvaney has protected Equifax from an investigation and punishment for letting personal data on 143 million Americans be hacked by shutting down an investigation started by former CFPB Director Richard Cordray into the data breach

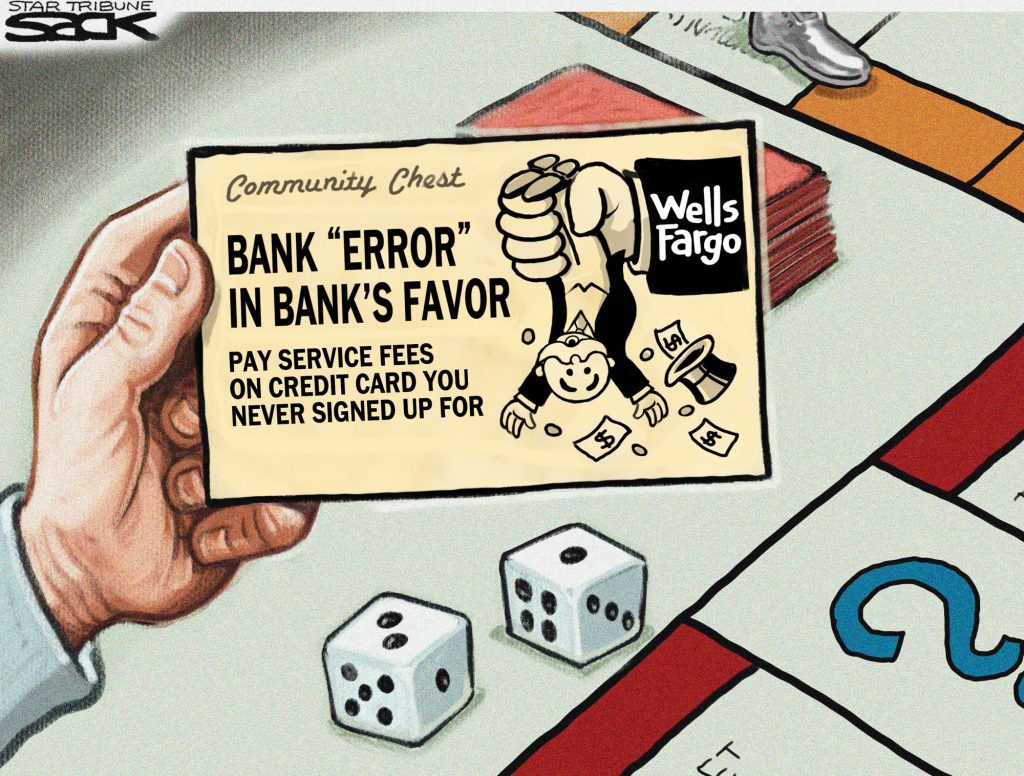

Part-time Director Mulvaney has been true to his word, he has stopped a full-scale investigation and possible punishment fines on Equifax for failing to protect the personal data of 143 million Americans, and the last major enforcement action the CFPB took was in September 2016 3 months before he and President Trump took office. It was a 100 million dollar fine against Wells Fargo Bank for the widespread illegal practice of secretly opening unauthorized deposit and credit card accounts, and funding them by transferring funds from consumers’ authorized accounts without their knowledge or consent, and topping it off by charging them a fee for the privilege of being ripped off. The Wells Fargo rip-off is an example of the ongoing need to have strong consumer protection enforcement and oversight of U.S. financial institutions.

If part-time Director Mulvaney gets his way the 100 million dollar fine on Wells Fargo Bank will be the last one on any financial institution for unfair practices by the CFPB

It’s important to know if President Trump colluded with Russia to interfere in our elections, it’s important to know if President Trump has people like Jared Kushner working for him that aren’t cleared to see top-secret information and it’s important to First Lady Melania Trump to know if President Trump is cheating on their marriage.

But for hard-working everyday Americans these things which get a lot of attention in the media matters the least, qualifying for an affordable mortgage, being charged a fair interest credit card rate, getting affordable education loans, not being ripped-off by unfair practices of a bank, and having a fully functioning government agency whose sole mission is to protect the personal bottom line of all Americans from fraud and abuse, is what matters most.