As a scion of Martin Luther King Jr., I do appreciate how one American citizen’s dream for America becoming a reality, can move America to a better place. In the 1980s former President, Ronald Reagan had a secret dream for America, now in 2025 Reagan’s secret dream is about to become a public reality, but unlike Dr. King’s dream which moves America to a better place, Reagan’s secret dream becoming a reality will move America to a worse place.

In 1981 during his first press conference as President of the United States, Reagan announced that he would send to Congress a request to increase the national debt ceiling to $985 billion, a $50 billion increase over the previous debt ceiling. His announcement shocked many conservative voters who voted for Reagan, who campaigned on the core conservative principle that federal government taxes were too high and federal government spending was too excessive. Since Reagan’s campaign promised to reduce federal taxes and federal spending, raising the national debt ceiling seemed to conservatives to be reneging on the campaign promise.

Conservatives who thought Reagan was reneging were conservatives unaware of Reagan’s secret dream, which received a major boost towards becoming reality 2 weeks ago when Moody’s became the 3rd credit rating agency, joining Standard & Poor’s and Fitch, by removing the pristine AAA credit rating for the United States of America. Standard & Poor’s was the first to do so back in 2011 when the Republican-controlled House threatened then-President Barack Obama, that they would not increase the debt ceiling to enable America to pay its debts, raising the possibility for the first time in human history that America would renege on paying what it owed. Fitch followed suit in 2023 citing repeated political down-to-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills. After the Republican-controlled House threatened former President Joe Biden with not raising the debt ceiling.

But the reason for the Moody’s credit downgrade hit much closer to the goal of Reagan’s secret dream, Moody’s cited America’s current debt combined with the future debt that President Donald Trump’s proposed budget will create as their reason for downgrading the credit rating of the world’s largest and most successful economy. In other words, Standard & Poor’s and the Fitch downgrades were about questioning America’s political will to pay America’s debt, the Moody’s downgrade is about questioning America’s financial ability to pay America’s debt, a major difference and major step towards achieving Reagan’s secret dream. Reagan’s secret dream since the 1980s was that the federal debt would become so high and so expensive that it would force federal government spending cuts. The Moody’s downgrade most likely played a major role in last Wednesday’s weak demand to buy U.S. Treasury bonds.

In order to sell the bonds the U.S. Treasury Department had to raise the interest rate U.S. taxpayers will have to pay to bondholders to over 5%, the highest rate since 2023. Raising the cost of borrowing the money America needs to fund its budget, is the essential part of achieving the ultimate goal of Reagan’s secret dream, to restrict what the federal government pays for. Reagan conservatives believed federal government spending should be limited to military expenditures, border security, the U.S. court and justice system, and law enforcement. While they support the principle of a social safety net to catch those in need, Reagan conservatives think the safety net should be paid for by the private and charity sectors, not the federal government.

In other words its not the federal government’s responsibility to help everyone but it is the responsibility of private charity to help everyone

From day 1 of his presidential campaign to his first inaugural address where he stated “Government is not the solution to our problem; government is the problem”, Reagan intended to eliminate or severely restrict what he referred to as “big government” spending on social welfare programs like Social Security and Medicare. After becoming President, Reagan realized that when a majority of his voters cheered on his campaign promise to cut or eliminate “big government” they were expecting elimination of or cuts to the fraud, waste, and abuse existing within the social welfare programs, not the elimination of or cuts to the funding for services the social welfare programs provide, making it clear to him that the political will to restrict federal government spending to military expenditures, border security, the U.S. court and justice system, and law enforcement did not exist.

So Reagan’s solution was to severely restrict the federal government’s income by giving huge tax cuts to corporations and the rich, which then forced the federal government to borrow money, by selling U.S. Treasury bonds, to pay for the social welfare programs that neither Congress had the political will nor the American people had the democracy will to eliminate or cut. Ironically it was die-hard balanced-budget Reagan conservatives that popularized federal government deficit spending!!! As former Vice President Dick Cheney proclaimed, when confronted by his former Secretary of Treasury Paul O’Neill about the fiscal crisis the needless Iraq War was creating, “Reagan proved deficits don’t matter”.

In other words, what Cheney meant was Reagan proved that it was ok to sacrifice the conservative balanced budget battle in order to win the federal spending conservative war. For Cheney, the sacrifice was necessary to conduct the needless Iraq War to overthrow Iraq’s Saddam Hussein, for Reagan conservatives the sacrifice was necessary to implement Reagan’s secret dream. Reagan and Reagan conservatives were so committed to winning a small government limited to only paying for military expenditures, border security, the U.S. court and justice system, and law enforcement war, that they set in motion a process to permanently lose the balanced budget battle, by making it politically acceptable to financially convert America from tax and spend to deficit-spend and borrow, creating future American debt repayments so expensive that it would force a radical reevaluation and radical new restrictions on where tax dollars could afford to be spent, the ultimate realization of Reagan’s secret dream.

Reagan’s secret dream is slowly becoming a public reality before our very eyes. Last fiscal year, 2024, for the first time in American history, interest payments on America’s debt were larger than America’s defense budget and America’s Medicare budget. If it ever comes down to making a hard choice between the two unfortunately for the sick and needy the defense budget will win every time. In fact, while economically the time for the hard choice hasn’t really arrived yet, President Trump’s “one big beautiful bill” passed by the House last week is already making the choice, it cuts $700 billion from Medicare, the largest in history, $290 billion from the Supplemental Nutrition Assistance Program (SNAP) America’s food stamp program, but increases the budget for defense and border security by $300 billion.

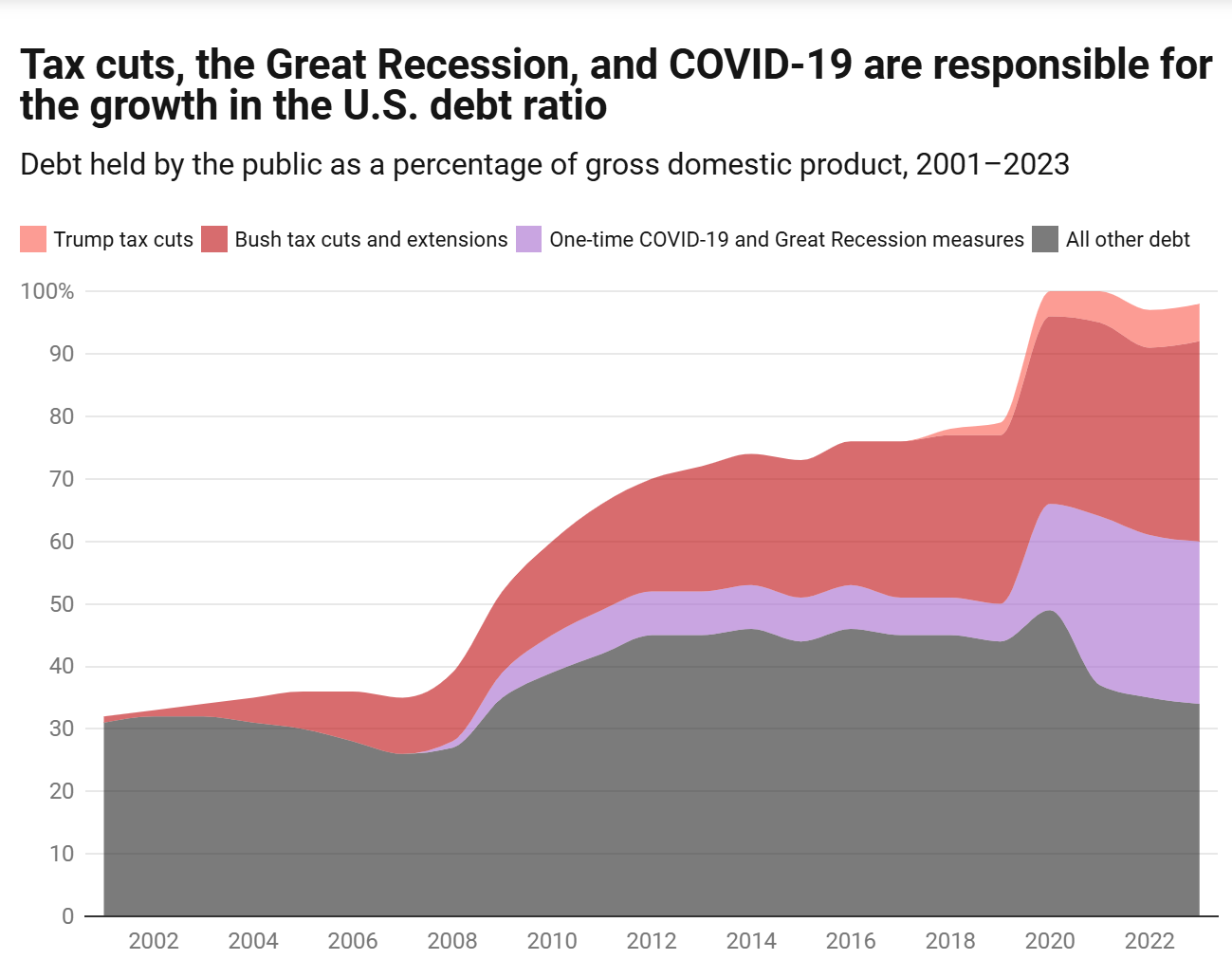

At this point there is only one thing that will stop Reagan’s secret dream from becoming a public reality, American citizens must face the reality that the largest contributor to American debt is not how much is spent on either social welfare or defense, the largest contributor to American debt is TAX CUTS. Since 2001 tax cuts have added $10 trillion to America’s debt. Contrary to the myth that tax cuts trickle down American economic benefits, in reality, tax cuts trickle up American debt!!! The tax cut myth is so pervasive that there’s hardly any Republican resistance to the new larger tax cuts proposed in the “one big beautiful bill”, the few Republicans who are resisting are the loudest voices calling for deeper social spending cuts to fund the new tax cuts.

But just as tax cuts are the largest contributor to America’s debt the lack of them could be the largest contributor to America’s debt reduction. If a miracle occurred and Republicans decided instead of extending and increasing the size of the tax cuts from the first Trump administration, which are due to expire this year, they let them expire and return to the same income tax rates that produced the healthy economy the first Trump administration inherited from Barack Obama, would reduce $4.5 trillion of America’s debt over the next 10 years, producing larger American debt reduction than any of the most extreme proposed spending cuts by far-right wing Republicans or Elon Musk.

Unfortunately, since the miracle of Republicans letting the current tax cuts expire is a pipe dream, The Tax Foundation estimates that “one big beautiful bill’s” new tax cuts will add $4 trillion to the over $35 trillion America already owes. Reagan’s secret dream is right about one thing over $35 trillion of American debt should concern Democrats, Republicans, Independents, liberals, conservatives, and libertarians. Fortunately, while Reagan’s secret dream is showing signs of becoming a public reality it’s not a public reality yet, America can still manage and grow itself out of its large debt. Because America still has a fiscally responsible opportunity to increase taxes just enough to decrease American debt, while keeping the increase small enough not to harm a thriving growing American economy.

Tax cuts are policies whose costs keep increasing, while the increase in the debt ratio caused by the Great Recession and legislation to fight it, in addition to the legislation to fight the health and economic effects of COVID-19, were temporary. While the Great Recession and COVID-19 increased the level of debt, it is therefore the tax cuts that continue to keep deficits high and exert upward pressure on the debt ratio even when the economic situation is more normal.

But first America must stop dreaming that deficit-spend and borrow tax cuts create trickle-down economic benefits, and wake up to the fact that deficit-spend and borrow tax cuts trickle up American debt!!!

Leave a Reply