Friday former National Security Advisor Michael Flynn pled guilty to lying to the Federal Bureau of Investigation (FBI), later that night while Democrats were focused on this nothing burger Senate Republicans passed a tax bill that will increase the debt, kill millions of people and raise taxes for the poor while giving the rich and corporations a tax cut. Democrats are showing the same stupidity that has caused them to lose 1,000 national, state, county and city elective seats across America since 2008. For its own survival and the well being of America Democrats must Forget Flynn!

Friday former National Security Advisor Michael Flynn pled guilty to lying to the Federal Bureau of Investigation (FBI), later that night while Democrats were focused on this nothing burger Senate Republicans passed a tax bill that will increase the debt, kill millions of people and raise taxes for the poor while giving the rich and corporations a tax cut. Democrats are showing the same stupidity that has caused them to lose 1,000 national, state, county and city elective seats across America since 2008. For its own survival and the well being of America Democrats must Forget Flynn!

Democrats like vultures on the scent of a dead carcass are focused on the Flynn guilty plea. They say his actions have violated the Logan Act, a 1799 law that prohibits U.S. citizens from attempting to influence ongoing disputes with a foreign government. It has been used against individuals only twice, both during the 19th century, and has never resulted in a conviction. Politico reports that the Senate Judiciary Committee’s top Democrat, Senator Dianne Feinstein, said “It’s critical that we determine whether Flynn spoke with the Russians on his own initiative and who knew and approved of his actions,” Democratic Sen. Richard Blumenthal said in a statement, “Flynn’s betrayal of national security is an enduring black mark on our country’s history and a stunning violation of his oath of office,” he urged the Judiciary panel to “pursue its investigation with new urgency.”

Democrats are panning for fool’s gold if they think anything that Michael Flynn would admit to or be found guilty of, would force a Republican-controlled House and Senate to impeach Republican President Donald Trump. President Trump is guilty of a lot of illogical behavior but none of it rises to the level of impeachment.

Senate Majority Leader Mitch McConnell (left) President Donald Trump (right)

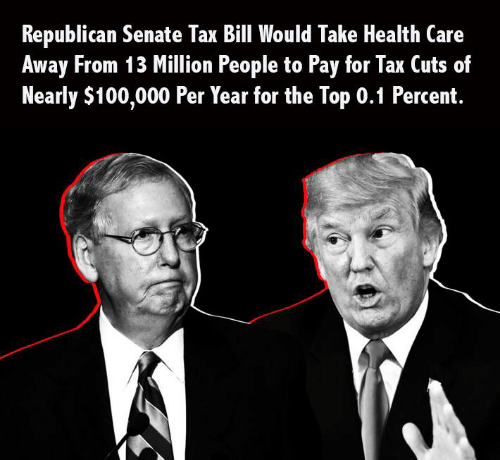

Even if you accept the exaggerations of Senators Feinstein and Blumenthal about the importance of the Flynn plea, it does not have a tenth of the effect that the Senate tax bill will have on American life. It will affect Americans in the following 4 important ways:

Healthcare cost- Under current law, you can get a tax deduction if your medical expenses are more than 10 percent of your income. You can deduct everything above that 10 percent. Republican Sen. Susan Collins got a temporary change so that it goes down to 7.5 percent, meaning you can deduct more, and also more people will qualify for that medical expense deduction which is a very good change but that change is only for two years. It won’t last very long, but it will help people with those expenses for a little while if it ends up in the final bill. It’s in the Senate bill, but it’s not in the House bill.

Tax deductions for private school tuition- This would change how the government looks at K-12 education. It would provide a government incentive for families to not choose public school, but instead get a tax deduction for sending their children to a private school or cost associated with schooling their kids at home. It’s not clear who or what entity would decide what qualifies for the homeschooling deductions.

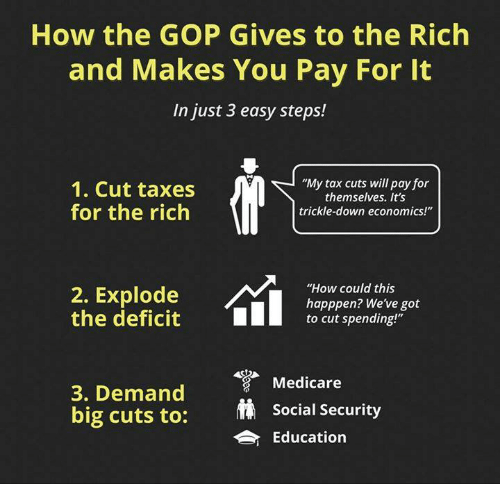

Fox News Chris Wallace (left) questions OMB Director Mick Mulvaney (right) on accuracy of economic projections

Debt and deficit- Currently we have a deficit that is on track, without this tax law, to be $30 trillion within 10 years. This bill would add another $1-2 trillion in debt that would bring us very close to a red line for economists, which is 100 percent of GDP, essentially saying in about 10 years, our debt would be equal to everything that is earned, done and owned in this country in a year. That’s a dangerous level. Republicans argue that their tax cuts will create so much growth that it will make up for all of the money that’s being borrowed, but there is not a single economic analysis that says specifically, this will pay for itself.

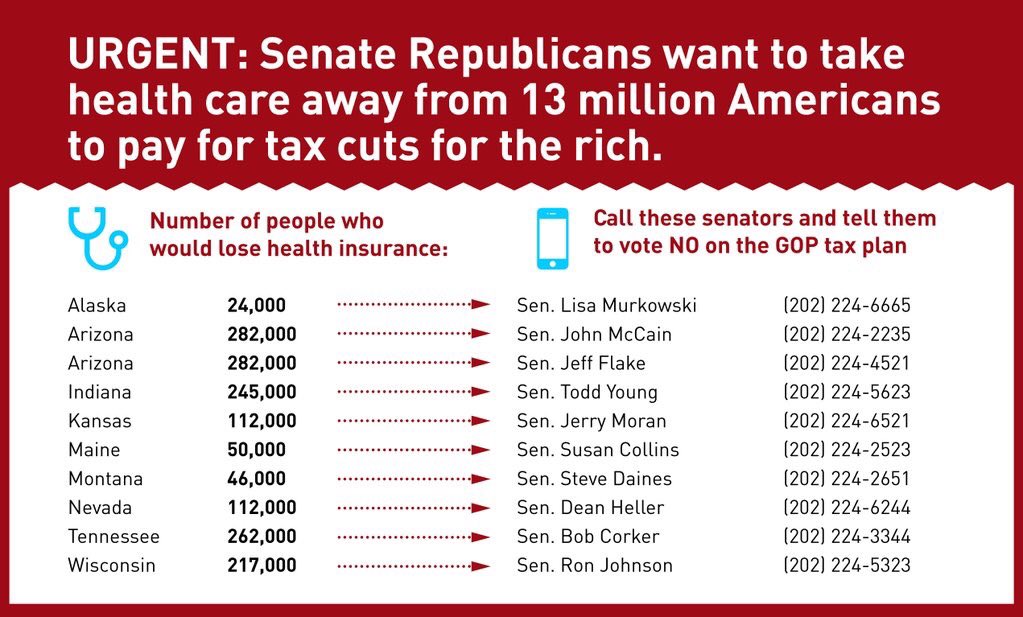

Affordable Care Act (Obamacare) – Senate Republicans added a provision to repeal the mandate that individuals buy health insurance. By adding this provision they get an extra 300 billion dollars to fund the tax cuts. The Congressional Budget Office estimates that repealing the provision means 13 million fewer Americans will have health insurance.

What happens with Michael Flynn or what secrets and broken laws he reveals only affect one American, President Trump. Democrats need to let Special Counsel Robert Mueller do his job, which is to root out and prosecute both Russian and Trump wrongdoing. They should focus like a laser beam on the final version of tax reform coming out of the joint committee of the House and Senate, because millions of American lives are affected by what’s left in the bill and by what’s left on the cutting room floor. Bottom line Democrats need to FORGET FLYNN and REMEMBER AMERICANS!